67% this year (through June 4th). Now let's take a glimpse at how to increase cash returns by doing simple rehab work that can attract much better renters and let you increase the month-to-month lease. As the name implies, "worth include" is anything that adds worth to the residential or commercial property and generates more gross capital.

Or, value adds can be jobs that increase gross income incrementally, such as installing brand-new energy-efficient devices or repainting the within your home in today's trendy designer colors. Neither project costs a great deal of cash but can have a positive psychological impact on the tenant, enabling you to gather more rent - how to become a real estate developer.

You haven't sustained any recurring expenditures, so that additional $50 per month drops directly down line. Your brand-new cash-in-cash return from this fairly minor worth include task is: Cash returned/ timeshare promotion orlando Money invested = Cash-on-cash return $3,720 cash returned ($ 3,000 initial money + $720 extra lease)/ $27,000 money invested ($ 25,000 down payment + $2,000 painting) = 13.

12% before including value Appreciation is another method that you can earn money investing in property. It's important to keep in timeshare in hawaii mind that appreciation isn't constantly a certainty, due to the fact that costs can increase as well as down from one year to the next. Nevertheless, history shows that the longer you hold property the higher your chances are that market worths will increase.

According to the Federal Reserve, over the last five years the mean list prices of houses in the U.S. have increased by about 13%. Let's look at what the possible cash-on-cash return of our rental property would be if we hold it for five years. We'll begin by building up the cash received over the previous 5 years: Preliminary deposit = $25,000 Net money flow over 5 years = $3,000 x 5 years = $15,000 Gain from appreciation = $100,000 purchase price x 13% appreciation over 5 years = $113,000 less mortgage financial obligation of $75,000 = $38,000 gain from gratitude Overall return = $15,000 total net money flow + $38,000 appreciation = $53,000 total return Now, let's determine the overall cash-on-cash return during our five year holding duration: Overall cash returned/ Total money invested = Cash-on-cash return $53,000 total money returned/ $25,000 total money invested = 212% Simply put, in simply five years, you have actually received more than 2 times the amount of money back compared to your preliminary quantity of money invested.

The Basic Principles Of How Do You Become A Real Estate Agent

However with that in mind, it's still simple to see how investing in property can create very remarkable money returns over a fairly brief duration of time. Actively investing needs you to take an active function in the property. Self-managing rental homes, and taking part in the building and construction, development, and rehabbing of realty of a few of the routine jobs required of an active investor.

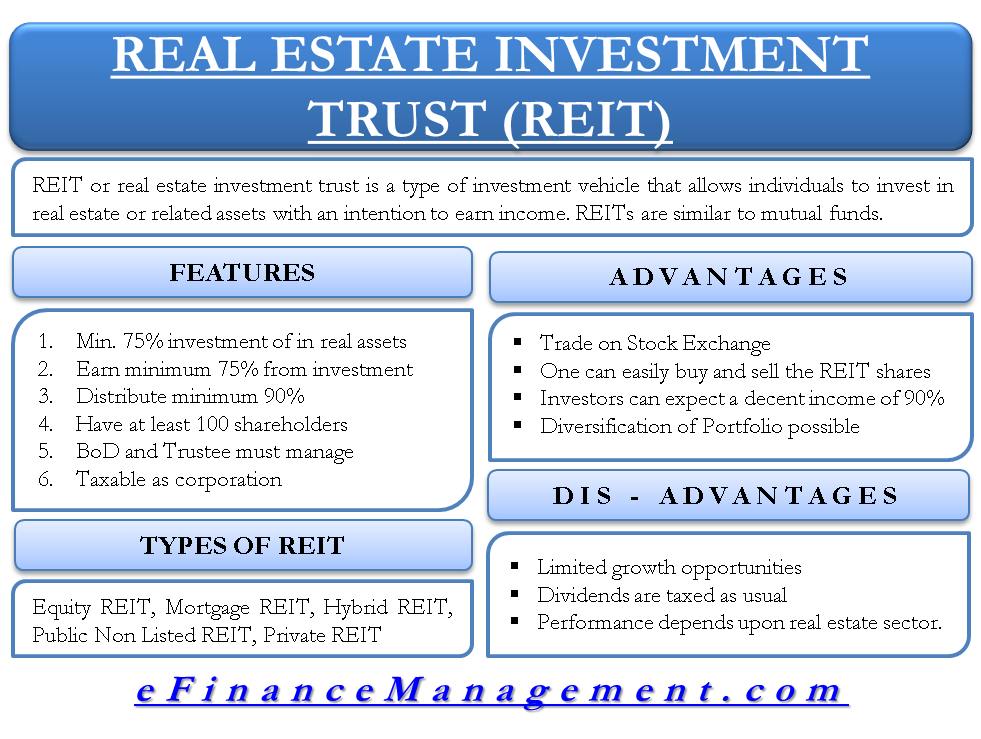

They're looking for ways to put their capital to work while letting someone else deal with the hectic work. You've probably become aware of passive realty investing without even realizing it. Some examples of passive investing include: Turnkey single-family and little multi-family rental property Joint ventures and collaborations Group investing Portfolio investing Crowdfunding and genuine estate fund investing REITs (genuine estate investment trusts) What all of these techniques of passive property investing have in common is that you contribute your capital while experts handle the daily activity to produce the biggest returns and make the most of residential or commercial property market worth over the long-term.

Class A core property can be discovered in the finest neighborhoods and school districts and provides a lower rate of return in exchange for a lowered level of risk. property offers opportunities to increase worth by doing updating to create more rent. Class B value add home is generally discovered in typical and above-average neighborhoods and school districts and uses a balanced mix of threat and benefit.

Realty wholesaling and fixing-and-flipping are two examples of how the opportunistic genuine estate investing strategy is used. There are also methods you can buy property without actually purchasing a home directly: Real estate financial investment trusts, property shared funds, and realty ETFs or exchange-traded funds let you purchase shares of stock in publicly-traded property funds Online property investment platforms for purchasing a portion interest in big investments such as commercial structures, apartment or condo jobs, or brand-new advancements Collaborations or JVs (joint ventures) have a managing partner actively involved in the daily operation and management http://titusgxtd824.bearsfanteamshop.com/the-facts-about-how-much-does-it-cost-to-get-a-real-estate-license-uncovered of the financial investment, while other passive investment partners contribute capital rather of their time.

It holds true though! Following years of social modification, commercial development, and economic fluctuations, genuine estate continues to be one of the most trusted financial investment alternatives. By conducting sound research study and making the most of favorable market conditions, you can find out how to. Listed below you will discover a number of prominent realty suggestions to put you on the path to financial flexibility.

8 Simple Techniques For What Is Ltv In Real Estate

Is it a multi-family or single-family house? Would you prefer purchasing industrial genuine estate? Each of these property classes carries differing degrees of risk and return. What's your time horizon? How soon will you require the cash? If it's a short-term investment, consider options (having actually cash locked up in a long-lasting rental residential or commercial property might not make good sense).

Research is vital. However, some individuals take planning and factor to consider to such a severe that it ends up being a stumbling block. is your primary opponent in property. Eventually, you need to bite the bullet and purchase when the. You must be able to estimate the cash flow of a property so that you understand when it's the correct time to purchase.

With a property rental home, you produce earnings by gathering lease from occupants. The cash you make from rent covers taxes, insurance, payments, repair work, updates, and any other expenses connected with property ownership. An excellent investor takes into consideration all the expenses they will incur by owning the residential or commercial property, and weigh them versus the prospective profits.

Determining your capital is a basic equation: subtract your overall expenditures from your overall income. The resulting figure is the amount of money you will create from your home. Here is a monthly cash circulation calculation example on a residential or commercial property you lease for $1,600 a month: Mortgage = $600 Taxes = $200 Insurance = $50 Reserve for repair work = $50 Residential or commercial property Management = $100 Your money circulation in this example is $600.

And, you can likewise endure a future rates of interest increase need to one come your way. After you have this number, you can compute your yearly return on financial investment. This is a percentage rate that tells you how much of your investment you return yearly. You can identify this number by taking your annual money circulation and dividing it by your preliminary investment.

Our How Much Does It Cost To Get A Real Estate License Statements

In this example, your return on financial investment is extraordinary. Anything above 15 percent is typically thought about to be a sound investment. If you find a residential or commercial property that can get you to an ROI of 15 percent or above, seize the chance and buy. There are now online marketplaces for turnkey leasing residential or commercial properties that do a great deal of the mathematics for you.